Taxes made easy.

As the old saying goes, in this world, nothing can be said to be certain except death and taxes. Neither of those things has a reputation of being fun or easy. While we didn't come up with an easier way to deal with death, we did reimagine the way that citizens manage and understand their tax situation. Serving as a personalized hub, this platform provides taxpayers the tools and resources they need to easily and safely manage their taxes. From verifying current tax year filing status, tracking a refund, obtaining a tax transcript, or managing account balance, it will guide taxpayers through everything they need to know.

myIRS HOME

Taxes can be stressful! You may want to know the status of your refund, understand how much you owe to the government, or make a payment on your balance, but as the existing tax management platform functions those key pieces of information are buried beneath legal jargon and a complex site structure. As a team, we believed that it was important to provide key information to taxpayers in a digestible way and to make it easy to navigate all of the possible functionality.

AMOUNT I OWE

We made it easy to understand one's tax history by consolidating the information in one central location. This reduces the burden on users to sort through dense government documentation and elevates the important information. We also ensured that users could clearly understand their tax debt by demonstrating the carry over from year to year.

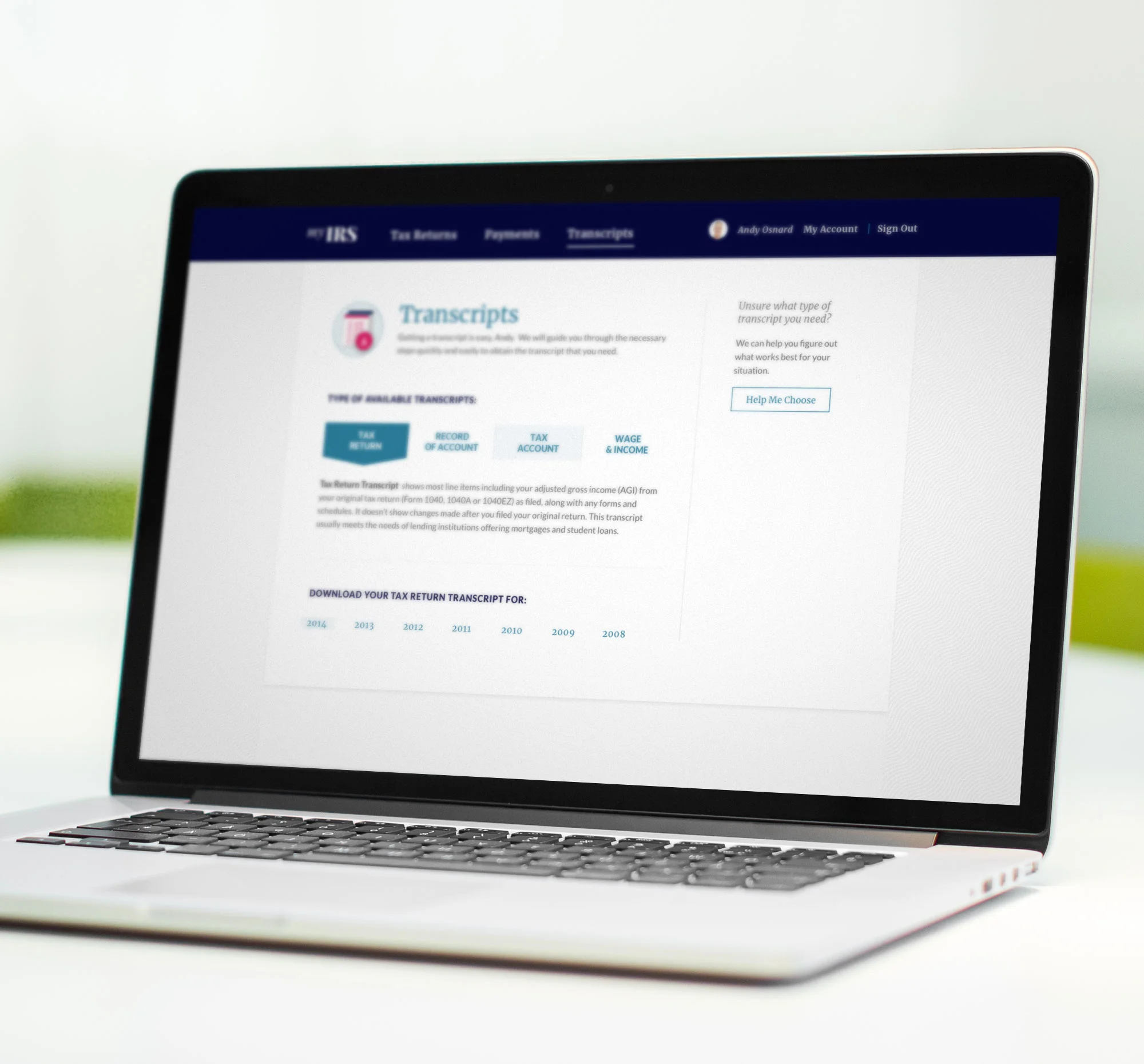

GET TRANSCRIPTS

One of the most common tasks for citizens managing their taxes online is getting their tax transcript. In the existing IRS.gov web it's not easy to find the exact transcript you need for the year that you need it. By using a tab structure to explain the different types of transcripts as well as show the available dates, we made it easier for taxpayers to find what they need when they need it.